Merck, now the world’s No. 2 drugmaker with Schering-Plough purchase, set for future deals

By Linda A. Johnson, APWednesday, November 4, 2009

Merck, now No. 2 drugmaker, set for future buys

TRENTON, N.J. — The new Merck & Co. has become the world’s second-biggest drugmaker overnight with a huge acquisition, but it still has a fat wallet and plans more wheeling and dealing.

A day after closing its $41.1 billion purchase of longtime joint venture partner Schering-Plough Corp., Merck already is looking to increase the number of acquisitions and licensing deals it does, Chief Executive Richard Clark said Wednesday. The company has averaged 50 deals a year since 2003.

“We’ll actually do more and maybe even try to double it,” he told The Associated Press exclusively.

Clark said Merck is looking to make deals with “biotech companies that have first or best-in-class products that can build our franchises.”

It has about $8 billion in cash and investments to spend.

Wall Street liked the Schering deal, pushing Merck shares up $1.97, or 6.4 percent, to end at $32.64 Wednesday, making it the top gainer among the Dow Jones industrial average components.

“We’ve got a tremendous pipeline, with 15 late-stage candidates,” Clark said.

Between those drugs and future deals, Merck is focusing on several areas, including its longtime strengths such as cardiovascular disease — with four new drugs in testing — and vaccines, adding Schering-Plough’s experimental shot to prevent staph infections to Merck’s array of standard child and adult vaccines.

Other targets are osteoporosis medicines, such as a Merck drug to replace its pioneering Fosamax, which has lost sales to generic competition, and women’s health, as Schering makes contraceptive and fertility drugs.

With the Schering deal, Merck leapfrogged from No. 8 to No. 2 in the industry by revenue, behind Pfizer Inc. — despite Clark insisting he opposed such a megadeal since he took Merck’s helm in 2005. Merck, of Whitehouse Station, N.J., and New York’s Pfizer, which last month bought Wyeth for $68 billion, are now back in the positions they held a decade ago.

Merck was the world’s top-selling drugmaker in the mid-1990s, but Pfizer took the lead in 1998 when it launched an overnight success, impotence pill Viagra. Repeated mergers among other drugmakers pushed Merck further back in line.

The new Merck will start off with roughly $40 billion in annual sales, operations in more than 140 countries and more than half its sales from foreign countries — an advantage as U.S. sales have stagnated in recent years.

“We’re going to be better in emerging markets,” Clark said, meaning countries such as China, India and Brazil with people now spending more on health care. The company also is more diversified, with Schering’s animal and consumer health businesses and biotech division.

“It really puts us on a global stage as a health care leader,” Clark said.

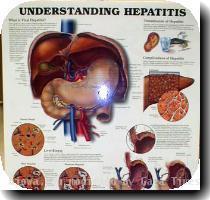

Schering-Plough, of Kenilworth, N.J., also brings several promising experimental drugs and some big sellers including hepatitis drugs and allergy spray Nasonex. The companies jointly sell cholesterol drugs Vytorin and Zetia.

About 40 percent of Schering-Plough’s top managers are staying on, but its CEO, Fred Hassan, is leaving with a severance package worth roughly $51 million.

The companies have said they expect to make about 16,000 job cuts out of their now-combined staff of 106,000 people. With no official word on those cuts, many employees are anxious.

Clark said Wednesday it will take time to decide which employees will leave and which facilities will close.

Joining the companies will save about $3.5 billion a year after 2011. By next year, Merck expects the deal to boost profits slightly, and it’s forecasting profit growth in the high single digits through 2013.

The new company is organized into five divisions, including its manufacturing operations and Merck Research Laboratories. The others are the prescription drug business and two Schering-Plough businesses, animal health and a consumer health business with well-known brands such as Claritin allergy pills, Miralax laxative, Coppertone sun care items and the Dr. Scholl’s footcare line.

Credit Suisse analyst Catherine Arnold wrote to investors that she is dropping her earnings-per-share estimate this year to $3.23 from $3.26, but increasing it to $3.66 from $3.28 next year, because of Schering-Plough’s revenue and other effects of the deal. Arnold is keeping her rating on the stock at “Neutral” and her 12-month price target at $35 a share.

Tags: Contracts And Orders, Diagnosis And Treatment, Health Care Industry, Medication, New Jersey, North America, Ownership Changes, Personnel, Trenton, United States